Pure historical cost system is symbolized in the top left section of Exhibit 2-2. Straight line or accelerated depreciation) the calculated cost of a unit of product or service simply represents an attempt to approximate the true cost. Since there are many alternative allocation methods, (e.g., But determining the cost of a product, or service requires many cost allocations, e.g., allocating the cost of fixedĪssets to time periods, and allocating indirect manufacturing costs, or overhead to products. The term actual costs is sometimes used instead, but the term "actual" seems to imply that there is one trueĬost associated with a particular output. In a pure historical cost system, only historical costs flow through the inventory accounts. These concepts are illustrated in Exhibit 2-2 and

ThereĪre three alternatives including: pure historical costing, normal historical costing and standard costing.

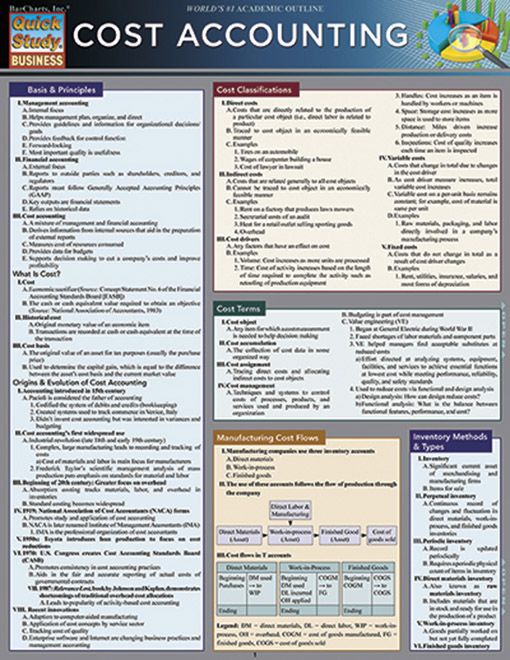

The basis of a cost accounting system begins with the type of costs that flow into and through the inventory accounts. Selecting one part from each category provides a basis forĭeveloping an operational definition of a specific cost accounting system. Of the available alternatives, although not all of the alternatives are compatible. Note that many possible cost accounting systems can be designed from the various combinations These five parts and the alternatives under each part are summarized in Exhibit 2-1. a capability of recording inventory cost flows at certain intervals. Management Accounting: Concepts, Techniques &Ī cost accounting system requires five parts that include:ĥ. Process costing, throughput costing, direct costing, absorption costing, backflush costing and historical costing must be combined with other costĪccounting methods to form a cost accounting system.

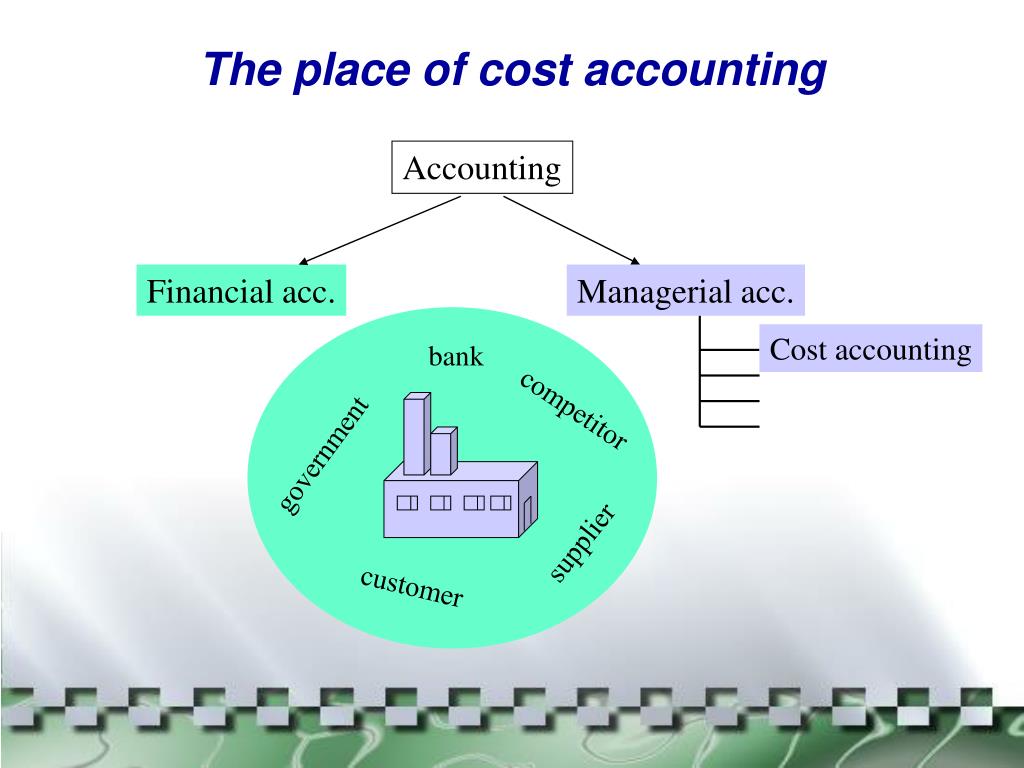

Cost accounting methods such as, activity-based costing, job order costing, standard costing, The graphic below illustrates some of the confusing terminology. The purpose of this section is to explain how the various methods, subsystems, or parts fit together to form a cost accounting system. However, these methods are only parts of a Inventory valuation methods and cost accumulation methods are frequently referred to as cost accounting systems in the accounting literature. Source: Management Accounting Concepts Techniques and Controversial Issues Professor Emeritus, University of South Florida The Five Parts of a Cost Accounting System

0 kommentar(er)

0 kommentar(er)